What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit . See examples of journal entries, depreciation, useful life,. Find answers to questions about interest,. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. The $6,000 added to the car purchase price is the applicable 5% tax for the car purchase. credit sale journal entry for purchase of a car. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider.

from indiafreenotes.com

Find answers to questions about interest,. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. credit sale journal entry for purchase of a car. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. See examples of journal entries, depreciation, useful life,. The $6,000 added to the car purchase price is the applicable 5% tax for the car purchase. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,.

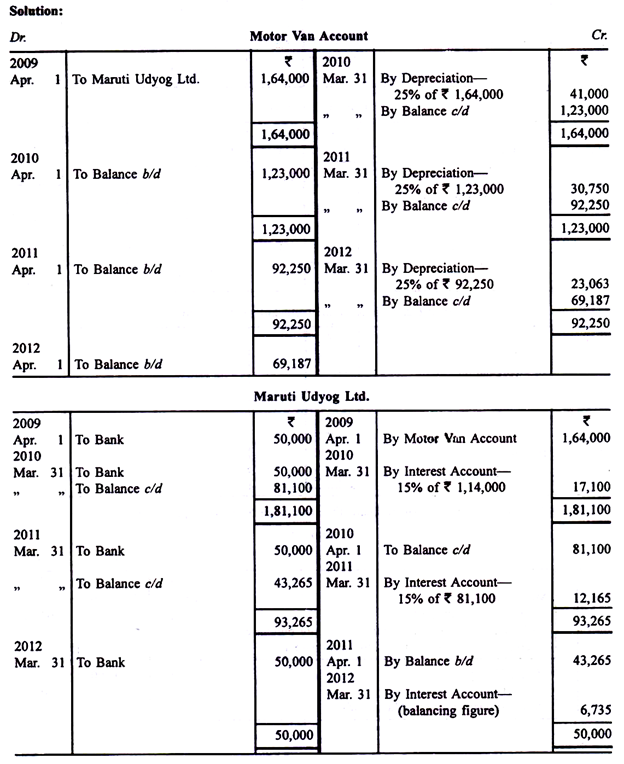

Journal Entries and Ledger Accounts in the Book of Hire Purchase and

What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. See examples of journal entries, depreciation, useful life,. The $6,000 added to the car purchase price is the applicable 5% tax for the car purchase. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. credit sale journal entry for purchase of a car. Find answers to questions about interest,. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users.

From indiafreenotes.com

Journal Entries and Ledger Accounts in the Book of Hire Purchase and What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit Find answers to questions about interest,. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. purchase of car journal entry this example is based on the purchase. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From dxoyumacp.blob.core.windows.net

Double Entry Journal Accounting Example at Lucille Knowlton blog What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit See examples of journal entries, depreciation, useful life,. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. purchase of car journal entry this example is based on. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.vrogue.co

Prepare Journal Entries To Record The Following Merch vrogue.co What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. The $6,000 added to the car purchase price is the applicable 5% tax for the car purchase. credit sale journal entry for purchase of a car. See examples of. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.youtube.com

Accounting Entry for Credit Purchase YouTube What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit credit sale journal entry for purchase of a car. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.geeksforgeeks.org

Journal Entry for Sales and Purchase of Goods What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. The $6,000 added to the car purchase. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From biz.libretexts.org

6.4 Analyze and Record Transactions for the Sale of Merchandise Using What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. when you purchase the car, you. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From khatabook.com

What is a Credit Sales Journal Entry and How to Record It? What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. Find answers to questions about interest,. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. The. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.carunway.com

Personal Car Introduced in the business Journal Entry CArunway What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. See examples of journal entries, depreciation, useful. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From brainly.in

Rectify the following entries. • Goods costing ₹1,000 have been What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit Find answers to questions about interest,. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. . What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.chegg.com

Solved Journal entry worksheet On December 31 , the company What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit See examples of journal entries, depreciation, useful life,. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. learn how to record the purchase of goods on credit. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.youtube.com

UniversityNow Perpetual Inventory and Journalizing Purchase Entries What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. when you purchase the car, you make a journal entry for. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From scandaloussneaky.blogspot.com

Insurance Claim Journal Entry What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit Find answers to questions about interest,. learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. See examples of journal entries, depreciation, useful life,. purchase of car journal. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From fabalabse.com

What is basic journal entry? Leia aqui What are basic journal entries What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. Find answers to questions about interest,. See examples of journal entries, depreciation, useful life,. credit sale journal entry. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.chegg.com

Solved Prepare journal entries to record each of the What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit Find answers to questions about interest,. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. . What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.financestrategists.com

Depreciation and Disposal of Fixed Assets Finance Strategists What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. purchase of car journal entry this example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. Find answers to questions about interest,. . What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From elvismeowjoseph.blogspot.com

Asset Purchase Journal Entry What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. learn how to record bookkeeping entries for vehicle purchase and loan payments from. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From www.youtube.com

Journal Entry for Purchase of Inventory YouTube What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit learn how to record bookkeeping entries for vehicle purchase and loan payments from experts and other users. credit sale journal entry for purchase of a car. See examples of journal entries, depreciation, useful life,. learn how to record the purchase of goods on credit and payment of cash against it in the company's books of accounts. . What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.

From animalia-life.club

Accounting Journal Entries For Dummies What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit when you purchase the car, you make a journal entry for the purchase of a fixed asset on credit, and more likely,. The $6,000 added to the car purchase price is the applicable 5% tax for the car purchase. purchase of car journal entry this example is based on the purchase of a car from a car sales. What Would The Journal Entry Be For The Purchase Of A Vehicle On Credit.